When it comes to buying a home, most people require a mortgage to finance the purchase. While the idea of a mortgage may be familiar, the concept of mortgage amortization might not be as well-known.

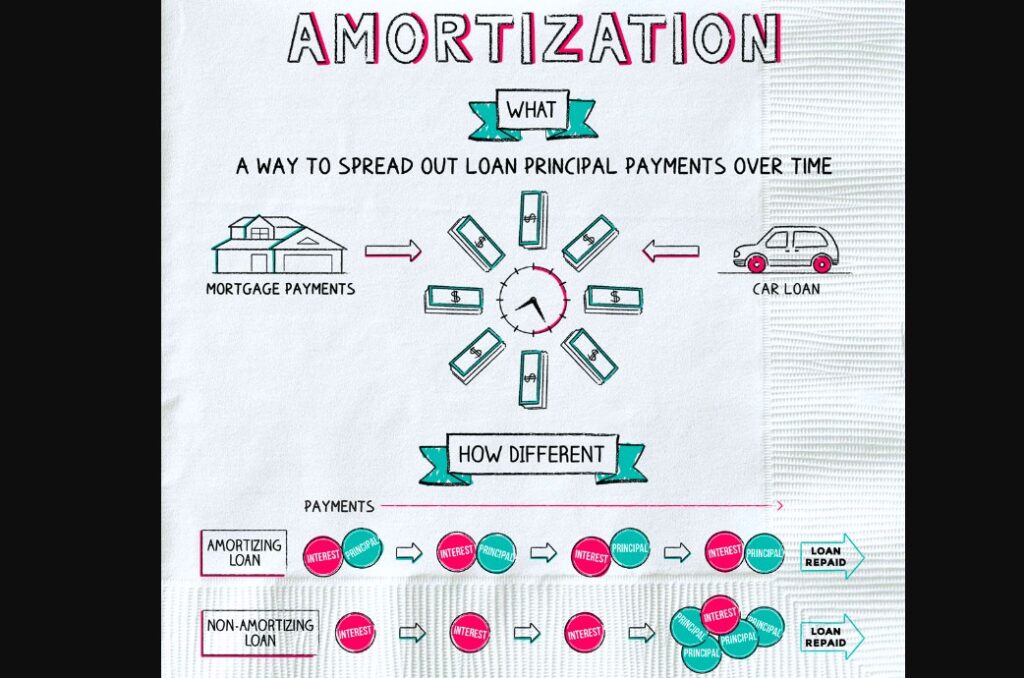

Mortgage amortization is the process of paying off a home loan through regular payments over time.

In this article, we will dive into the intricacies of mortgage amortization, exploring how it works, its benefits, and important factors to consider.

Purchasing a home is a significant financial commitment, and understanding how your mortgage works is crucial.

Mortgage amortization plays a vital role in determining the repayment schedule and interest costs associated with your loan.

By gaining insight into the process, you can make informed decisions regarding your home financing. Let’s explore the basics of mortgage amortization and its various aspects.

What is Mortgage Amortization?

Mortgage amortization refers to the systematic repayment of a mortgage loan through scheduled payments over an extended period.

It involves both the repayment of the principal amount borrowed and the interest charged by the lender. Over time, as the mortgage is paid off, the principal balance decreases, and the interest portion of the payment decreases accordingly.

The Basics of Mortgage Amortization

To grasp mortgage amortization fully, it’s essential to understand the fundamental elements that shape the repayment process. These elements include the principal and interest, loan term, and interest rate.

Principal and Interest

The principal refers to the original loan amount borrowed from the lender. As you make payments, a portion of each payment goes toward reducing the principal balance.

The interest, on the other hand, is the cost charged by the lender for borrowing the money. It is calculated based on the outstanding principal balance and the interest rate.

Loan Term

The loan term is the duration over which the mortgage is repaid. Common loan terms range from 15 to 30 years, although other options may be available.

The longer the loan term, the lower the monthly payments but the higher the total interest paid over the life of the loan.

Interest Rate

The interest rate is the annual percentage charged by the lender on the outstanding loan balance.

It determines the amount of interest paid over the life of the mortgage. A lower interest rate reduces the overall interest cost, making the mortgage more affordable.

The Amortization Schedule

Mortgage amortization follows a predetermined schedule known as the amortization schedule.

This schedule outlines the payment amounts, the allocation of payments between principal and interest, and the remaining principal balance at each stage.

Monthly Payments

Mortgage payments are typically made on a monthly basis. Each payment covers a portion of the principal and interest due for that month.

In the early years of the mortgage, a larger portion of the payment goes toward interest, while the principal repayment gradually increases over time.

Allocation of Payments

Within each payment, the amount allocated to principal and interest changes. In the beginning, a larger portion of the payment goes toward interest, gradually decreasing as the loan term progresses.

Towards the end of the mortgage term, a more substantial portion of the payment goes toward principal reduction.

Benefits of Mortgage Amortization

Understanding the benefits of mortgage amortization can help you appreciate its significance in your financial journey.

Predictable Payments

Mortgage amortization allows you to have predictable monthly payments. This stability enables you to budget effectively and plan for other financial obligations.

Equity Buildup

As you make regular mortgage payments, you build equity in your home. Equity represents the portion of the property that you own outright.

With each payment, you gradually increase your ownership stake, which can be beneficial for future financial goals.

Understanding Interest and Principal Components

It is essential to comprehend how the interest and principal components vary throughout the mortgage term.

Early Years vs. Later Years

During the early years of a mortgage, the interest portion of each payment is higher compared to the principal.

As time passes, the principal component grows, and the interest portion decreases. This shift occurs due to the reduction of the outstanding principal balance over time.

Impact of Extra Payments

Making extra payments towards your mortgage can significantly impact the amortization process. Additional payments directly reduce the principal balance, leading to faster equity buildup and potential interest savings over the long term.

Amortization Methods

Several methods can be employed to manage mortgage amortization effectively. Understanding these methods can help you choose the approach that aligns with your financial goals.

Standard Amortization

The standard amortization method involves making fixed monthly payments throughout the loan term. This approach ensures stability and predictable payments.

Biweekly Payments

With biweekly payments, you make half the monthly payment every two weeks, resulting in 26 payments per year. This method can lead to earlier loan payoff and interest savings over time.

Accelerated Amortization

An accelerated amortization strategy involves making additional payments above the regular monthly amount.

These extra payments go directly towards reducing the principal balance, accelerating the loan repayment process.

Factors Affecting Mortgage Amortization

Several factors can influence the mortgage amortization process. Understanding these factors can help you make informed decisions regarding your home loan.

Loan Amount

The loan amount directly impacts the amortization schedule. Higher loan amounts result in larger monthly payments and longer repayment periods.

Interest Rate Changes

Fluctuations in interest rates can affect the amortization process. Changes in interest rates may lead to adjustments in monthly payments or overall interest costs.

Refinancing

Refinancing your mortgage can have an impact on the amortization schedule. By refinancing to a lower interest rate or a shorter loan term, you may be able to save on interest costs and pay off your mortgage sooner.

Mortgage Amortization and Tax Benefits

Mortgage amortization has implications for your tax obligations and benefits.

Mortgage Interest Deduction

In many countries, homeowners can deduct the interest paid on their mortgage from their taxable income. This deduction can lead to tax savings and make homeownership more financially advantageous.

Tax Implications of Paying Off a Mortgage

Paying off a mortgage completely can have tax implications, and it is essential to understand the potential impact on your tax situation.

Read More:

- Big Data Technologies of Data Analysis And Business Intelligence

- Understanding The Dynamics Of The Insurance Business

- Types And Advantages Employee Benefits Insurance Coverage

- Safeguarding Small Business Income Protection Insurance

- Protect Yourself with Liability Insurance Coverage

Mortgage amortization is a fundamental aspect of homeownership, shaping the repayment journey and financial implications of your mortgage.

By understanding how mortgage amortization works, its benefits, and the factors that influence it, you can make informed decisions regarding your mortgage and financial future.